Every year, parents of enrolled and prospective college students should complete their part of the Free Application for Federal Student Aid (FAFSA) for financial aid from the Federal government, their state, and the student’s college. Over 13 million students file the FAFSA annually to become eligible for $120 billion in need-based Federal grants, work-study, and loans. Parents need to provide tax, income, and certain asset data and sign the online form.

To assure that funds are not awarded to students that don’t need them, the U.S. Education Department (ED) analyzes each family’s financial condition. Certain information is required from parents of dependent students under age 24 so that the level of need of the family can be determined. But even though the majority of students live in the household of their married parents, many do not. There are students with parents who are unwilling or unable to participate in the FAFSA process. The ED and colleges have procedures designed to assist these students, if possible, in obtaining Federal financial aid.

I. FAFSA Rules Regarding Parents

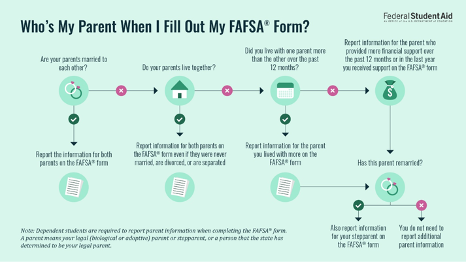

Diagram A, below, is ED’s illustration of how a student’s parents (this term always includes guardians) are determined for FAFSA purposes:

Diagram A: Identifying Parents for the FAFSA

Below is an overview of the FAFSA rules concerning the identification of parents:

- Legal Parents

• If a student’s parents (biological or adoptive) are married to each other, questions about both of them must be answered regardless of whether the parents are of the same or opposite sexes.

• If the student’s parents are not married to each other but live together, the FAFSA should answer questions about both of them regardless of whether they are of the same or opposite sexes.

• If a student’s parent is widowed or was never married, the FAFSA should include answers to questions about only that parent.

- Divorced or Separated Parents

• Married parents are considered separated under FAFSA rules if they are considered legally separated by a state or if they are legally married but have live separate lives in separate households as though they were not married.

• When two married persons live as a married couple but are separated by physical distance or have separate households, they are considered married under FAFSA rules and both must answer FAFSA questions.

• If a student’s parents are divorced or separated and don’t live together, the FAFSA questions should be answered about the parent with whom the student lived for the longest period of time over the last year.

• If a student lived for an equal amount of time over the last year with each divorced or separated parent, questions should be answered about the parent who provided more financial support during the year.

- Stepparents

• Students who have a stepparent who is married to the legal parent for whom questions are answered on the FAFSA must also obtain answers to the questions about the stepparent.

• If the student’s stepparent was married to his or her parent but is now widowed, that stepparent isn’t considered a parent on the student’s FAFSA unless the stepparent has legally adopted the student.

II. When Parents Refuse to Complete the FAFSA

A student whose parents refuse to participate in the FAFSA process should first try to understand their reasons. Some issues are solvable. Typical scenarios involving nonparticipating parents are:

- A parent is concerned that financial data will be seen by a spouse in a divorce.

- Parents who have immigrated to the U.S. are worried about their legal status.

- Parents don’t want to share their financial status with their children.

- Parents don’t want to reveal that they didn’t submit tax returns in the required year.

If a student can identify the parent’s objections, they can advise them about a possible solution. For instance, the first two scenarios above are solvable. Even if parents are getting divorced, each spouse’s FAFSA information is confidential. If parents are worried about their U.S. residency status, they should be aware that there are no immigration-related questions on the FAFSA and parents don’t need to provide their residency status.

Despite best efforts, a student may not be able to convince parents to complete the FAFSA. Since a student is not considered legally independent for FAFSA purposes until they’re 24, they must try to qualify for a dependency override. In such cases, the student can fill out the FAFSA without the financial information or signature of a parent. A dependency override will not be automatically granted simply because parents are unwilling to participate in the FAFSA process There must be extenuating circumstances, such as:

• A history of abuse by the parent or a dangerously hostile relationship,

• The parent is incarcerated,

• Neither parent can be located, or

• The parent is physically or mentally incapacitated and unable to provide the required information.

Students cannot qualify for a dependency override solely because their parent don’t support them financially. The following situations do not qualify a student for an override:

• The parents refuse to contribute to a college education,

• The parents refuse to sign the FAFSA,

• The parents don’t claim the student as a dependent on their taxes, or

• The student is completely self-sufficient.

Applying for a dependency override starts with selecting the option on the FAFSA that states, “I am unable to provide information about my parent(s).” This prevents the ED from calculating a Student Aid Index (formerly known as Expected Family Contribution). It is then up to the college’s financial aid office to decide if the student may receive institutional financial aid and/or an unsubsidized Federal direct loan. Even students who don’t qualify for an override should discuss their circumstances with their college’s financial aid office.

The college’s financial aid staff will ask the student for additional information to determine if they can be considered independent. With such information, the college may calculate a factor similar to the Student Aid Index for its own purposes without parental data. Students should have as much written evidence of their status as possible. This may include:

• Court or law enforcement documents,

• Letters from clergy, high school counselors, or social workers,

• Letters from the director of a program funded under a Gaining Early Awareness and Readiness for an Undergraduate Program grant, and/or

• Other relevant documentation that helps verify the student’s circumstances.

The financial aid office’s decisions about the student’s dependency status and financial aid eligibility is final and cannot be appealed to the ED.

Recent Comments