MIKE’S MEMOS

The One Place To Get Insider Strategies On College Admissions, Saving Money On Tuition & Much, Much More

Policy Agenda of the Institute for College Access & Success

The Institute for College Access & Success (TICAS) is an independent, nonprofit research and policy organization that strives to increase college access, affordability, and success. Headquartered in Oakland, California, with a satellite office in Washington D.C.,...

Update on the Federal Work-Study Program

The Federal Work-Study (FWS) Program provides a way for students to earn money to help pay for their education by working part-time while in a college. Over 3,400 schools participate in the program, which is managed by the Student Aid Office of the U.S. Education...

Colleges That Award the Most Merit Aid

Previously, we posted an article titled, “Tuition Discounts Offered as Merit Aid” regarding the practice by colleges of awarding partial merit scholarships to qualified applicants (also called discounted tuition). There are two reasons why this practice has become...

Funding Issues Currently Facing Community Colleges

A number of recent developments currently threaten the country’s 1,100 two-year community colleges (CC’s). CC’s educate about 6.4 million undergraduates earning associate degrees and students completing work certification programs. This is 40% of the national total of...

Trade School Costs

A trade school is an educational institution that provides hands-on training and specialized instruction for careers and skilled trades rather than a broad academic curriculum. Their programs are intended to prepare students to fill a specific role in the workforce....

The Common Application Gets a Make-Over

In the past, we have focused on the Free Application for Federal Student Aid (FAFSA) as the key to making college more affordable. However, since a student must apply to and be accepted by a college before affordability even becomes an issue, there’s another online...

Divorce Planning to Cover the Cost of College

Divorce planning and college costs intersect in complicated ways, especially when financial aid is involved. Careful planning through a divorce transition can result in the preservation of more of the income and assets of parents and children. The preserved income and...

Funding Issues Currently Facing Community Colleges

A number of recent developments currently threaten the country’s 1,100 two-year community colleges (CC’s). CC’s educate about 6.4 million undergraduates earning associate degrees and students completing work certification programs. This is 40% of the national total of...

Disabled Borrowers Are Eligible for Loan Forgiveness

If a former college student with an outstanding Federal loan balance becomes disabled, he or she may not need to repay that debt under the provisions of the Total and Permanent Discharge (TPD) program. To obtain debt forgiveness, the individual needs to apply for the...

What’s New for the FAFSA for 2026-27

Since the comprehensively revised Free Application for Federal Student Aid (FAFSA) was introduced in December, 2023, for the 2024-25 academic year, FAFSA operations have been unsettled, to say the least. However, they have slowly and painfully been improved over the...

College Lists Should Have Affordable Safety Schools

A high school senior’s College List is a key element in the success of their college admissions campaign. It is the set of colleges to which the student plans to apply over the next few months. They are colleges that that student determine are exceptionally...

College Lists Should Have Affordable Safety Schools

A high school senior’s College List is a key element in the success of their college admissions campaign. It is the set of colleges to which the student plans to apply over the next few months. They are colleges that that student determine are exceptionally...

Using 529 Accounts for Non-Academic Education

Among educational savings plans, 529 accounts are the most widely used and popular option. There are about 17 million 529 accounts currently valued at over $525 billion. For years, 529 accounts have been considered to be educational savings plans intended for college...

The Affordable Loans for Students Act

The Affordable Loans for Students Act (the Act) was introduced in Congress on March 10 as an amendment to the Higher Education Act (HEA) of 1965 for the purpose of lowering Federal student loan interest rates to 2%. The rate reduction will apply to all borrowers,...

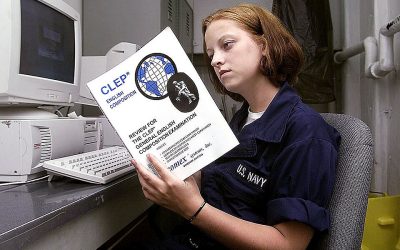

Use the College-Level Exam Program to Full Advantage

The College-Level Exam Program (CLEP) may be the best deal in American post-secondary education. People who didn’t go to college directly after high school as well as other non-traditional students working full-time can earn credits at a college without taking courses...

Can a Student Renege on an Early Decision Agreement?

Students who have been accepted by a college through an Early Decision (ED) program should consider themselves fortunate, and most do. They’ve applied to a school at or near the top of their target list and have been admitted before most of their fellow students have...

The CSS Profile Can Lead to a Scholarship

The CSS Profile is an online college application administered by the College Board. Each year, use of the CSS Profile application allows students to access over $10 billion in non-Federal student aid. Annually, over 430,000 students receive an average of $45,000 in...

How H.R. 1 Will Impact Student Loan Programs

In the last post, we covered H.R. 1 of 2025 (the Big Beautiful Bill), which, in Title III, proposes major changes to Federal student aid programs. The changes in Title III take effect on July 1, 2026, and apply to award year 2026–27 and subsequent years. It’s now in...

House Bill Would Overhaul Federal Student Aid

The U.S. House of Representatives passed the annual budget reconciliation bill, designated as H.R. 1, on May 22. Title III of the legislation contains the Committee on Education and Workforce’s proposed changes to the Department of Education’s (ED) student aid...

Can Colleges Control Administrative Bloat?

College tuition rises much faster than general inflation, a fact that has been well known for some time. Lately, however, sky high tuition has colleges on the horns of a dilemma. Limited in ways to grow revenue such as offering new programs or recruiting more foreign...

Overview of Federal Direct Student Loans

Federal Direct Loans are government-backed financial aid options provided by the U.S. Education Department (ED) to help students afford the costs of higher education. Direct Subsidized Loans offer an initial interest-free period during college years for eligible...

Overview of Federal Parent PLUS Loans

A Parent PLUS Loan (PPL) is a Federal student loan program that helps parents finance their dependent children's college education, making it a vital resource for families facing rising college costs. Carrying a fixed interest rate of 9.08% for both the 2024-25 and...

The Pro’s and Con’s of Private Student Loans

Private student loans are financial products offered by private lenders to help students finance their college education. They are distinct from Federal student loans provided by the government. Private loans have the potential to fill funding gaps when Federal...

The Impact of Inflation on College Savings

When surveyed by The College Investor (TCI), 75% of parents with college-bound children said that they are currently saving for their child’s college education. TCI also found that over 80% of parents are concerned about the impact of inflation on college savings. The...

Transferring Loan Accounts Damage Borrower Credit

A student loan borrower may be contacted by the marketing arm of a Federal student loan service provider for the Education Department (ED) at any time during the term of the loan. The borrower will be asked to transfer their accounts to that provider in exchange for...

Federal Student Loans: Resolving Delinquency

If a former student is past due on a Federal student loan, there is an obvious way to bring the loan account current. The borrower simply pays the past due amount and continues on with his or her payment plan. However, most delinquent borrowers are unable to do this,...

Using IRS Section 127 for Family Members

When companies compete for the best employees, the quality of their benefits packages is a key differentiator. Prospective employees look for a comprehensive package that will improve their financial condition and help them prepare for the future. An IRS Section 127...

Using UTMA/UGMA’s to Save for College

The Uniform Transfers To Minors Act (UTMA) and the Uniform Gifts to Minors Act (UGMA) are two laws that combine to produce the acronym “UTMA/UGMA”. They are useful tools for parents and others seeking to reduce taxes while accumulating assets for college. First came...

CollegeSure CD’s Help Families Cope with Inflation

In saving for a child’s education, parents want to know if they will have the funds necessary to pay the costs of college when the time comes. An dilemma they face is that, due to inflation, their objective is unknowable in advance. Tuition Inflation Many experts...

SAVE Repayment Plan Quashed By Courts

The cost of a college degree in the United States has tripled since 1980. Since access to a college education has long been a bipartisan priority, Congress and the Executive branch have attempted to keep pace with skyrocketing tuition. Over the past half century,...

Another FAFSA Failure Will Delay Aid Payments

The most recent failure in the rollout of the new Free Application for Federal Student Aid (FAFSA) will leave many college students without critical financial aid as the fall semester approaches. On July 30th, the U.S. Education Department's (ED) announced their...

The AP Program: The Good News and the Bad News

Two outcomes of a student’s admissions campaign indicate success; first, being accepted by targeted colleges, and second, being able to afford them. Earning high grades on Advanced Placement (AP) exams can foster both results. This is why the AP program is viewed as a...

The Pros and Cons of Parent Plus Loans

Federal Direct PLUS Loans, commonly referred to as Parent PLUS Loans (PPL’s), are uncollateralized loans made by the U.S. Education Department (ED) to the parents of dependent students to help pay for college. PPL’s are a type of Federal loan intended for parents,...

The Financial Impact of College Closures

After working hard to qualify for admission, high school seniors look forward to their college years with high hopes. But what happens to their hopes if they enroll in a college that closes its doors soon after they matriculate? Some students may choose to attend an...

The Impact of the FAFSA Fiasco on Students

Due to the disastrous rollout of the new FAFSA, most new and continuing students still don’t know how much college will cost them next year. This makes it even harder than usual for high school seniors to decide where, or if, to enroll by the pending deadlines. FAFSA...

The New FAFSA Continues to Vex Students

Remember Murphy's Law? It’s the adage that "Anything that can go wrong will go wrong, and at the worst possible time." The development and rollout of the “Better FAFSA” by the U.S. Education Department (ED) is a prime example of Murphy’s Law in action. In a normal...

Thirty Million Borrowers Set for Debt Relief

On April 8, President Biden released the details of his new student loan debt forgiveness plan. The plan would reduce payments for 26 million borrowers and erase all debt for four million more. Ten million of these borrowers will receive debt relief of over $5,000...

Crunch Time for the FAFSA Rollout

The Free Application for Federal Student Aid (FAFSA) is the means by which students obtain their fair share of the billions of dollars in Federal, state, and college financial aid to help defray the cost of college. The problems affecting the current admissions cycle...

Consider Best Value Colleges

The annual ranking of Best Colleges published by U.S. New & World Report (U.S. News) receives plenty of press coverage when it’s released in September. Perhaps as a result, the U.S. News rankings are relied upon by many students and parents in their search for the...

Biden Cancels $1.2 Billion More in Student Debt

Since 2021, the Biden administration has forgiven $138 billion in student loans for 3.9 million borrowers. The Administration announced on February 21 that another category of borrowers would have their loans forgiven by the end of the month. This $1.2 billion tranche...

The Test-Optional Movement May Be Waning

Colleges never favored using standardized test scores as the primary criterion in admissions. They did considered them useful as the only means of comparing applicants on an apples-to-apples basis. In the early aughts, however, a movement emerged to make test scores...

Distance Education Lowers the Cost of a College Degree

The traditional image of college education features students in a classroom with a professor lecturing them. But lately, more and more students are opting to take college classes online rather than in classrooms. Students engage with their coursework, classmates, and...

Impact of the New FAFSA on the Net Price of College

The student financial aid system has always been complex. With this year’s new FAFSA and its inept rollout by the U.S. Education Department (ED), it will be even more baffling for all parties — students, parents, guidance counselors, Federal and state agency staffers,...

Education Department To Correct New FAFSA

As noted in a recent post, the U.S. Education Department (ED) announced in December that the revised FAFSA would be initially released as a “soft launch” on January 1 and that it would only perform a data store-and-forward operation for data processing by the ED at...

College Savings and Divorce Planning

There can be issues with college savings that the spouses had initiated together even in amicable divorces, Divorce attorneys are legal experts but not financial aid experts. They may not be aware of all of the consequences of divorce on a child’s eligibility for...

Using a CollegeSure CD to Save for College

According to the College Tuition and Fees price index maintained by the U.S. Bureau of Labor Statistics, the cost of tuition was 1,490% higher in 2023 than it was in1977. Between 1977 and 2023, tuition — the largest component in the cost of attending college —...

Guard Against Student Aid Scams

One reason for the establishment of the U.S. Education Department (ED) in 1979 was to assist students in paying for a post-secondary education. Like corporations that market to consumers, the ED conducts much of its business with its student-consumers over the...

The “Non-Launch” of the 2024–25 FAFSA

The 2024–25 Free Application for Federal Student Aid (FAFSA) is now available through a soft launch by the Federal Student Aid (FSA) office of the U.S. Education Department (ED). It is online at Studentaid.gov and Fafsa.gov. The FSA released the following announcement...

CLEP Exams Help Non-Traditional Students Earn a Degree

The College Level Examination Program (CLEP) may be the best deal in American post-secondary education. Non-traditional students such as those who didn’t go on to college directly after high school and now work full-time can earn college credits without taking college...

Trouble Ahead — The New FAFSA’s Impact on Student Aid

Submission of the Free Application for Federal Student Aid (FAFSA) is an essential step for all students seeking Federal, state, institutional, and private financial aid. To improve the financial aid process, the FAFSA Simplification Act was enacted by Congress on...