Earlier this month, two researchers — adam looney of the treasury department and constantine yannelis of stanford university — released an analysis of a new database of student debt.

For years, student debt has been shrouded in mystery. Now, for the first time, there’s clarity. In the past, we knew the total number of aid borrowers (40 million people) and their combined debt ($1.2 trillion and counting). Now we can finally answer questions like who is borrowing? And who is defaulting?

This information is particularly poignant now as the campaign for president heats up. Each candidate is promoting their own strategy to help in the debt crisis. Sadly, most of their emphasis has been on giving aid to graduates of 4-year colleges, the people who it turns out least need it!

The primary error in popular perceptions of student debt has been the assumption that overall debt is driven by $100,000 debts incurred by students at expensive private colleges in the northeast.

The reality is just the opposite.

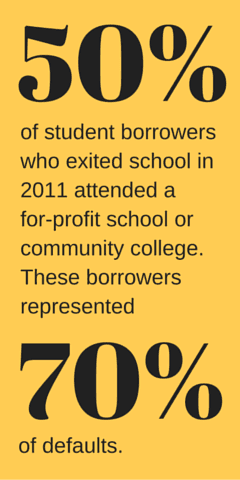

Student debt (and the rise in defaults) is being driven up primarily by $10,000 loans at for-profit and community colleges. There are three drivers in the amount of debt and defaults incurred by students from these schools.

For-profit students represented half of the increase in borrowers between 2003 and 2013. These loans may be of smaller overall amounts, but there are many more of them.

Many students at these schools never graduate, even though the programs typically run from six months to two years. They are left holding debt that they must repay, yet their average earnings hover around $22,000 a year for those leaving school in 2010 — not enough for many to repay even a modest loan amount.

Students graduating from for-profit and community colleges have a much higher unemployment rate than students coming from 4-year colleges. Joblessness makes it next to impossible to repay a student loan debt. For borrowers with $10,000 or less in debt, including workers who have been in the work force for years, typical income is only about $40,000.

Debt is a very real concern, not just for the nation, but for all the individuals and families who struggle to repay their loans. My heart really goes out to these people. They’re not the problem. They system is.

If the thought of paying for college a concern for you, please take advantage of our no-cost q&a sessions, where I share a number of our proven strategies to ensure overwhelming debt isn’t an issue for you or your student for years to come. Sessions can be scheduled by emailing christy or calling our office at 630-971-2300.

Recent Comments